LT Plan - Depreciation Benefits

Depreciation, its tax credit implication and the terminal year effects of capital not yet depreciated are important considerations. The LT Plan Depreciation Method attribute can be set to either:

- straight line

- declining balance

In addition these methods require input of Tax Rate and Inflation Rate.

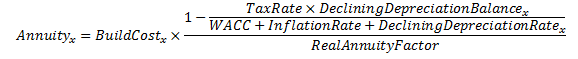

These methods affect the annuity calculations for Project x as follows:

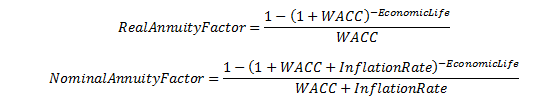

For both methods we compute both real and nominal annuity factors:

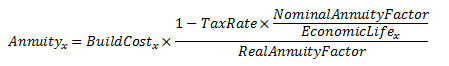

For straight line:

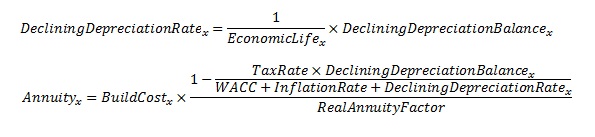

For declining balance:

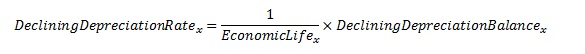

The Generator attribute Generator Declining Depreciation Balance attribute is provided and used as follows:

The key point to note with both of these formulations is that the tax effect of depreciation must be treated on a nominal basis, hence the adjustment of the real WACC by the rate of inflation. Also note that if no WACC rate is set, the discount rate is used.