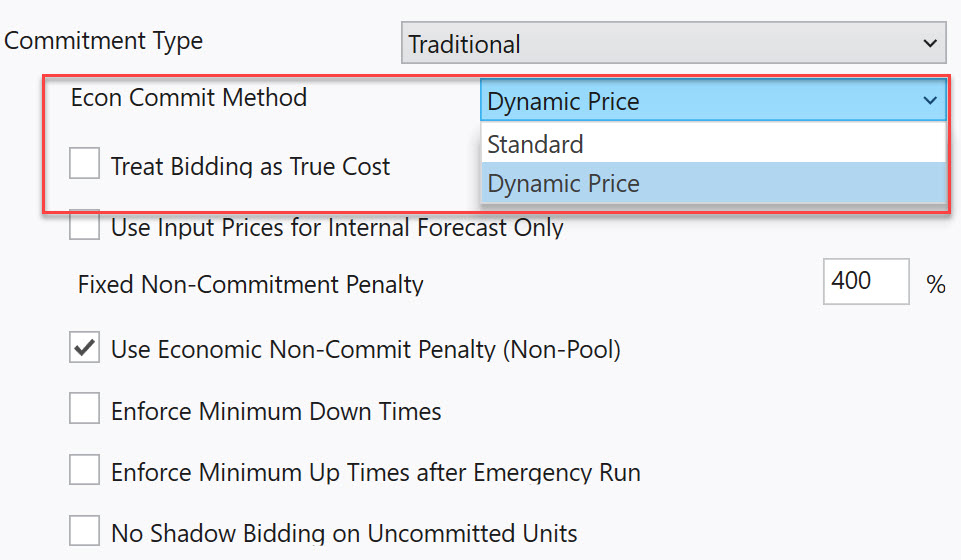

Econ Commit Method

This option selects which economic commitment method will be used for pre-forecast.

-

Standard - This method updates the price forecast every hour, but the 168 hour forecast for each zone remains static within each hour. See Commitment Logic article for more information.

In general, the standard commitment algorithm represents a self-scheduling IPP point of view, i.e., there is an expected set of prices, and they schedule the plant ahead of time. Sometimes too many resources schedule and the price falls below expected; sometimes not enough is scheduled and it is higher than expected. This method does have an advantage of capturing some of the impact of a real issue in the marketplace – that of over/under commitment as stated above.

-

Dynamic Price - This method applies a dynamic internal forecast adjustment within each hour as commitment decisions are being made. With this methodology the 168 hour-ahead forecast for each zone is updated not only every hour, but also within each hour as units are evaluated for commitment. Generally, with this method, prices will be slightly higher than the Standard method above. With this option selected, the logic is applied exclusively to both the pre-forecast and the commitment logic for all resources not using the Pool-based Commitment logic.

This method provides a price signal to the Standard method above, allowing the system to recognize that over/under commitment will have price impacts. The system will converge on a commitment pattern that will make the marginal units close to being economically whole. This is the recommended method for mature, established markets.

Note that when using the dynamic price method, the reliability-based pool commitment algorithm will be used for all resources in the system for the first day of the study. Any resources without membership in a commitment pool will return to economic commitment using the dynamic price logic on the first hour of the second day of the study. Any resources specified for pool commitment will continue to use the pool-based commitment.

For that first day, if an Operating Pools table is included in the study, the applicable configuration and input data from the Operating Pools and Zone Definition tables will be used. If an Operating Pools table is not specified for the study, each zone in the study will be treated as a separate pool. Relevant default input variable values will be used: Spinning Reqt = 3.5%, Firm Imports = 0, Firm Exports = 0. See Pool-Based Commitment for more information.

![]() Econ Commit Method

Econ Commit Method