Long-Term Studies Using Reserve Margins

Aurora provides the capability to perform optimized long-term system expansion studies which will install resources to meet your specified planning reserve margin targets. It builds resources to meet target reserve margins and simultaneously provides estimates of the capacity price payments necessary to support the marginal entrants supplying capacity to the system.

The methodology is an extension of the current iterative energy valuation logic. It produces a development schedule which is co-optimized for revenues derived from the hourly energy prices as well as the revenue stream for capacity payments.

The target reserve margin capability is supported at both the zone and pool level. The option can be used at just the zone level to meet zone reliability targets if operating pools are not active within a study. It can also be used in a study where pools are active to both meet minimum reserve margin criteria at individual zone levels within a pool, but also to meet a potentially higher reserve margin for the entire pool, letting the algorithm choose which resources in which zones are the most cost-effective to meet the overall pool target.

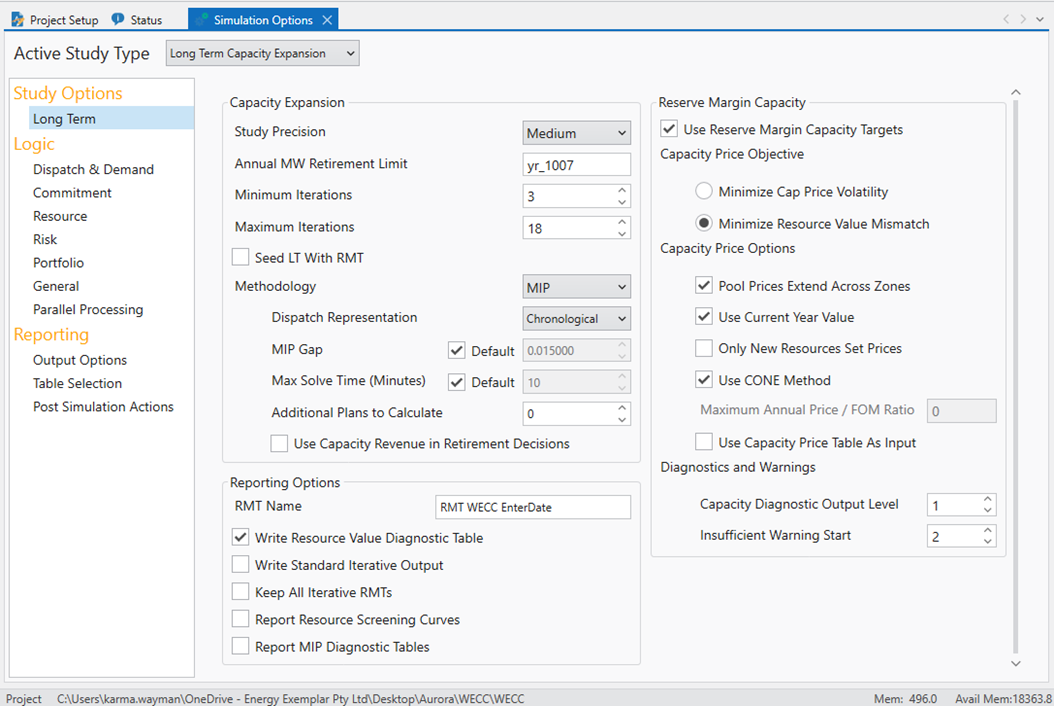

This expansion option is enabled for a long-term optimization study when the Use Reserve Margin Capacity Targets option in the Long Term folder of Simulation Options is selected.

When the Pool Prices Extend Across Zones option is enabled, all zones in a pool will have a capacity price equal or greater than the pool price. A zone may have a capacity price greater than the pool only if there is a binding zonal target reserve margin constraint for that particular zone.

When the Only New Resources Set Prices option is enabled, then only new resources added in the current study year are eligible to set the capacity price.

Additionally, if the Use CONE Method option is selected the long-term logic will incorporate the specification of a CONE (Cost of New Entrant) unit in the capacity pricing logic. This option shows improved stability as well as creates a more robust cross-technology selection of new entrants, improving the build-out mix of new resources for complex systems. When using this method the capacity pricing logic is performed every iteration, providing contemporary pricing for build-out decisions.

Note that the ability to meet the targets specified is dependent on the number, size, and timing of new resource alternatives available in each zone. If insufficient new resources are specified to be available, warning messages will be generated noting the timing, size, and location of the insufficiency.

When using this option, the annual peak demand calculated for the relevant zones or pools will be based on the actual hourly demand for all hours in the year, regardless of the sample hour configuration used for dispatch. In addition to the selections in the Long-Term folder of Simulation Options, there are several variables in the input tables that control the reserve margin expansion logic. There are parallel sets of the following variables available in both the Operating Pools and Zone Definition tables:

An additional resource variable named Peak Credit is available to control the level of resource capacity which can be used to meet the reserve margin criteria. It can be defined at either the individual resource level in the Resources table, or at the fuel level in the Fuel table. If the column is missing, the value will default to 1.0.

Note that by default the model may build more than is needed to meet the reserve margin target if it sees that it is economic to do so. If you want to minimize the overbuild that occurs in a given pool, set the flag, Minimize Reserve Margin, to True for the pool. The model will not build resources that it sees as economic which would go significantly past the reserve margin target.

The following two examples briefly illustrate the setup for the reserve margin target option. The first example is a Zone Only (No Pools) study; the second example pertains to a study Using Operating Pools. The examples assume that a long-term run has been selected, and the Use Reserve Margin Capacity Targets option is selected.

Example 1. Zones Only (No Pools)

The following image shows where the objective is to control reserve margins only at the zone level. Use the Planning Reserve Margin column in the Zone Definition table to enter the target reserve margin for each running zone. Use the Firm Imports and Firm Exports columns to reflect potential contracts or other firm rights which should be accounted for in the reserve margin calculations.

Example 2. Using Operating Pools

This example uses 26 running zones, with three multi-zone pools present in the study. The pools are defined using the Operating Pools table as shown below. The relevant columns for the capacity expansion logic are again Planning Reserve Margin, Firm Imports and Firm Exports.

Pool membership is defined using the Zone Definition table. The data here specifies a target reserve margin for each member of a multi-zone pool to be 5%, with pool level targets set at 15% in the Operating Pools table. This model will attempt to maintain at least a 5% reserve margin in each zone within the pool, and a 15% reserve margin for the pool as a whole. For zones not defined as a member of a pool and have no target reserve margin specified, a default value of 15% is used.

![]() Long-Term Studies Using Reserve Margins

Long-Term Studies Using Reserve Margins