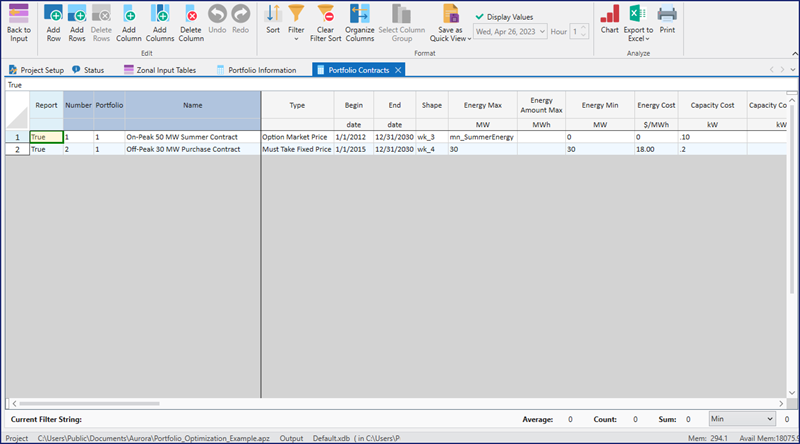

Portfolio Contract Table

![]() NOTE: To perform a Portfolio analysis, click the Run Portfolio Analysis check box in the Portfolio folder of Simulation Options.

NOTE: To perform a Portfolio analysis, click the Run Portfolio Analysis check box in the Portfolio folder of Simulation Options.

This table provides for input of contracts used in the portfolio logic of Aurora. This information can provide power cost analysis for any entity that the user may want to define or for portfolios of contract groups (or positions taken in the market). It evaluates costs and value as well as risk.

A number of different types of contracts (for both purchases and sales) may be entered in this table. This allows the user to provide a combination of contracts that exactly replicate nearly any circumstance. The result is a very versatile and powerful tool in which positive (energy inflow) and negative (energy outflow) energy values can be included in the table to represent individual contracts or combinations can be used to simulate contracts that are more complex.

![]() NOTE: The number of Portfolios available to the user is inherently unlimited in Aurora. The only practical limitation may be due to input data structure.

NOTE: The number of Portfolios available to the user is inherently unlimited in Aurora. The only practical limitation may be due to input data structure.

![]() NOTE: Financial values for portfolio contracts are input in nominal terms.

NOTE: Financial values for portfolio contracts are input in nominal terms.

Examples

For more detailed information on Portfolio Contract types, please visit the Support area of our website. (Accessing the examples at www.energyexemplar.com/client-login will require the customer company login credentials. Please contact Support if you do not know your login.) Then go to AURORA Portfolio Workbooks. Each workbook contains a detailed description of the contract type and example sheets to walk you through the contract.

|

MUST TAKE OR DELIVER CONTRACTS |

OPTIONS CONTRACTS |

RESOURCES CONTRACTS |

REQUIREMENTS CONTRACTS |

OTHER CONTRACT TYPES |

|

|

||||

|

|

||||

|

|

||||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

|

|

COLUMNS INCLUDE |

|||

![]() Portfolio Contract Table

Portfolio Contract Table