Balancing Markets

Contents

- Introduction

- Balancing Generation Offers

- Balancing Load Bids

- Best Practices for Batteries and Storages

- Day Ahead and Real Time Coupling

- Interleaved Run Mode

- Passing Data between Day Ahead and Real Time

- Relevant Outputs from Day Ahead

- Worked Example - Pumped Hydro DA-RT Strategy

1. Introduction

In a balancing market, participants define their dispatch levels from day-ahead market outcomes. The real-time and day-ahead markets are commonly denoted RT and DA respectively.

Bid and offer properties can be used to study balancing markets:

- Generators can use properties Offer Base (for Generation) and Pump Bid Base (for Pump Load),

- Batteries can use properties Offer Base (for Generation) and Bid Base (for Load) etc.

The objective of the balancing process is to select optimal increments (incr) and decrements (decr) around the DA positions to meet changes from DA to RT. Several conditions can change in RT, including load (which may be higher or lower than that used for DA market closure and hence DA market positions).

2. Balancing Generation Offers

Input pairs Offer Quantity and Offer Price can be used to define incr and decr offers.

- Positive quantities are interpreted as offers to increment dispatch above a base quantity, and

- Negative quantities are interpreted as offers to decrement dispatch below a base quantity.

The impact on system cost is the product of the incr/decr quantity and the offer price. Thus with a positive price, an incr increases system cost and a decr decreases system cost.

To prevent decr bids below a certain point (such as a Generator's Min Stable Level), a negative Offer Price can be used with a decr bid band. This increases system costs when decrementing below nominable ranges. Offer Price is otherwise typically positive for both incr and decr offers.

In the context of balancing markets, the base quantity equals the DA generation (

Offer

Base

). Decrement offer bands represent reductions from this base and are defined up to the base quantity. Quantities above Offer Base represent the

incremental cost of moving the generation above the DA generation.

Example

The following shows a balancing market offer with a 200MW generator with a day-ahead generation of 100MW and Min Stable Level of 80MW.

| Property | Value | Units | Band |

|---|---|---|---|

| Max Capacity | 200 | MW | 1 |

| Min Stable Level | 80 | MW | 1 |

| Offer Base | 100 | MW | 1 |

| Offer Quantity | -80 | MW | 1 |

| Offer Quantity | -20 | MW | 2 |

| Offer Quantity | 80 | MW | 3 |

| Offer Quantity | 20 | MW | 4 |

| Offer Price | -9999 | $/MWh | 1 |

| Offer Price | 28 | $/MWh | 2 |

| Offer Price | 30 | $/MWh | 3 |

| Offer Price | 9999 | $/MWh | 4 |

In this example the generator has a day-ahead Generation

of 100 MW. If the system chooses to dispatch the generator at 100 MW

it incurs zero

Cleared

Offer Cost

, but if it increments the generator dispatch, it pays

the prices defined by the positive offer quantities i.e. the first

megawatt increment would cost $30 for up to 180MW dispatch (an 80MW increment from its DA position), then $9999 above

that to the Max Capacity.

However, if the system chooses to decrement the generation it is paid

the prices associated with the negative quantities i.e. the first

megawatt decrement earns the system $28, and this price holds for

decrements up to 20MW, below which the system must pay $9999 per unit

of decrement (since the decrement bid price is negative).

Thus, incr offers are cleared from lowest to

highest priced, while decr offers are cleared highest to lowest priced

(as if the DA dispatch were being 'unwound').

3. Balancing Load Bids

For pumped storage generators, input pairs Pump Bid Quantity and Pump Bid Price allow incr and decr bids to be defined around a base quantity of controlled load (Pump Bid Base). For batteries, the equivalent properties are Bid Quantity, Bid Price and Bid Base.

Example

The following shows incr and decr balancing market load bids for a battery.

| Property | Value | Units | Band | Memo |

|---|---|---|---|---|

| Max Load | 300 | MW | 1 | - |

| Bid Base | 130 | MW | 1 | Load drawn (charging) from DA market closure. |

| Bid Quantity | -130 | MW | 1 | Negative quantity for a decr bid, down to 0MW load. |

| Bid Quantity | 170 | MW | 2 | Positive quantity for an incr bid, up to Max Load. |

| Bid Price | 35 | $/MWh | 1 | - |

| Bid Price | 40 | $/MWh | 1 | - |

4. Best Practices for Batteries and Storages

For Batteries, It is good practice to define decr offers and bids which are 'full', i.e. defined down to 0MW Generation/Load. Variations in region load, prices and other factors between DA and RT can lead to differences in SoC. If RT offers and bids have zero or no decr, the battery is 'locked in' to Discharge/Charge due as no litte/no variation from its DA position has been defined. The DA dispatches may violate Min SoC/Max SoC due to DA/RT SoC variations, leading to infeasibilities. This problem is most acute for balancing market simulations involving many small RT steps in the absence of Look-ahead.

Full decr bids should also be defined for Pumped Storages with limited Energy Storage Capacity. An alternative is to disable Enforce Bounds in RT.

In DA-RT balancing schemes, End Effects Recycling can often be disabled in RT. As an example with "Head" and "Tail" Storage objects:

| Storage | Property | Value | Units | Bands | Scenario | Memo |

|---|---|---|---|---|---|---|

| Head | End Effects Method | 0 | - | 1 | DA | DA enforces storage recycling |

| Head | End Effects Method | 1 | - | 1 | RT | Allow RT storage to change from DA |

| Tail | End Effects Method | 0 | - | 1 | DA | DA enforces storage recycling |

| Tail | End Effects Method | 1 | - | 1 | RT | Allow RT storage to change from DA |

Here the End Effects Method is set to "free" in RT, meaning the Storage End Volume can deviate from the DA solution if optimal for balancing.

5. Day Ahead and Real Time Coupling

The DA and RT markets are clearly linked:

- In RT, the base bid and offer quantities (i.e. Offer Base, Bid Base) are products of DA market outcomes.

- Unit commitment statuses in RT can optionally be fixed from DA market outcomes.

- In DA, initial conditions depend on choices made in RT. Consider a day-by-day DA-RT simulation. Storage Initial Volumes and Battery Initial SoCs for day 2 of DA depend on the dispatches made in day 1 of RT (i.e. after balancing), rather than the day 1 DA result.

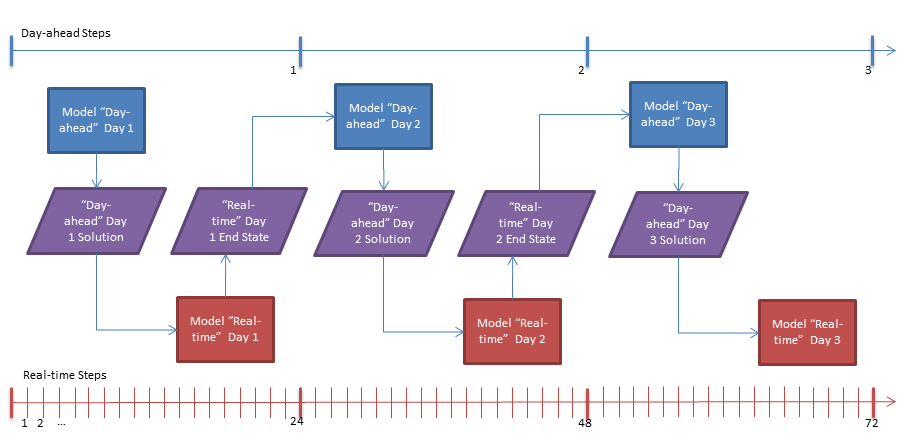

Simulation of day-by-day balancing markets therefore requires alternating simulation: DA day 1 setting base quantities for RT day 1, which sets initial condition information for DA day 2, which is followed by RT day 2 etc. Each day may be further decomposed into smaller problems (multiple hourly steps etc.).

6. Interleaved Run Mode

Interleaved is a simulation mode designed to address the DA-RT coupling. Interleaved simulations run both DA and RT models concurrently: DA outcomes pass information (i.e. Offer Base) to RT, and RT outcomes pass initial conditions back to DA. Interleaved is described further in Model and is illustrated in Figure 1.

Figure 1: Interleaved Run Mode

Figure 1: Interleaved Run Mode7. Passing Data between Day Ahead and Real Time

PLEXOS allows for the solution of one Model

to act as input for subsequent Models

via the Data File class. This is

particularly useful for modelling balancing/RT markets

because it allows Generation, Load and other DA outcomes to be

passed from the DA simulation to the RT simulation

without intervening manual intervention or data processing.

Note: The Data File Filename wildcard (*) causes properties to be passed directly between simulations during execution:

there is no actual file created. In balancing markets, DA outputs used in RT are passed directly: there is no intervening write to CSV files (i.e. via Report Write Flat File)

followed by a read.

As an example, consider a DA model "DA" producing Generator Generation

for a Generator Offer Base in an RT model. The following datafile should be defined:

| Data File | Property | Value | Units | Band | Filename |

|---|---|---|---|---|---|

| Generator DA Gen | Filename | 0 | - | 1 | Model DA Solution\interval\ST Generator(*).Generation.csv |

Multiple generators can define RT Offer Base from their (likely separate) DA positions via this single data file. For example for generators G1 and G2:

| Generator | Property | Value | Units | Band | Data Files | Scenario | Memo |

|---|---|---|---|---|---|---|---|

| G1 | Offer Base | 0 | MW | 1 | Generator DA Gen | RT Offers & Bids | - |

| G2 | Offer Base | 0 | MW | 1 | Generator DA Gen | RT Offers & Bids | - |

Where DA is simulated at a different interval resolution to RT, the data passed between the models is automatically upscaled or downscaled. The method used for up/downscaling can be controlled by the Data File Upscaling Method if resolution increases from DA to RT, or vice versa with Downscaling Method . If these are not defined then the method is chosen that best suits the property e.g. Generator Commit is upscaled using the "Step" method, whereas Fixed Load is upscaled using the "Interpolate" method.

PLEXOS automatically passes relevant initial conditions from RT to DA. No input or configuration is required from the user.8. Relevant Outputs from Day Ahead

Some output properties for relevance as RT simulation inputs are now identified. DA price outputs are useful in RT as offer/bid prices, and may include:

| Class | Generation Pricing Outputs | Load Pricing Outputs |

|---|---|---|

| Generator | SRMC, Price Received | Pump Price Paid |

| Battery | Price Received | Price Paid |

Maximum incr bid quantities are also of interest in RT (i.e. offer/bid quantity, increment band). Some units may have long unit commitment times and the commitment of new units may be impossible in the RT market timeframe. Relevant output properties for such units include:

| Class | Generation Output for Max Incr (no additional RT commits) | Load Output for Max Incr (no additional RT commits) |

|---|---|---|

| Generator | Undispatched Capacity | Undispatched Pump Capacity |

| Battery | Undispatched Generation Capacity | Undispatched Load Capacity |

| Class | Generation Output for Max Incr (additional RT commits) | Load Output for Max Incr (additional RT commits) |

|---|---|---|

| Generator | Unused Capacity | Unused Pump Capacity |

| Battery | Unused Generation Capacity | Unused Load Capacity |

| Class | Generation Output for Max Decr | Load Output for Max Decr |

|---|---|---|

| Generator | Generaton | Pump Load |

| Battery | Generation | Load |

9. Worked Example - Pumped Hydro DA-RT Strategy

An example DA-RT bidding strategy for a pumped storage Generator "Pumped Hydro 1" is now given. This example can be followed for generating-only units by neglecting all information concerning bids and pump load. The scenario is as follows:

- Unit commitment is taken from DA: no additional Units Generating or Units Pumping may commit in RT. The DA Generation/Pump Load form the Offer Base/Pump Bid Base respectively.

- In RT, one incr/decr offer is defined for generation and one incr/decr bid is defined for load (pumping).

- The generation incr offer is priced at 1% above DA SRMC (Offer Price). All Undispatched Capacity from DA is offered.

- The load incr bid is priced at 1% below DA Pump Price Paid (Pump Bid Price). All Undispatched Pump Capacity from DA is offered.

- The decr offers and bids are priced at the DA SRMC and Pump Price Paid respectively. The decr offers and bids are 'full' and take the station down to 0MW generation/load.

The following Data File definitions link to the "DA" Model solution:

| Data File | Property | Value | Units | Band | Filename |

|---|---|---|---|---|---|

| Generation | Filename | 0 | - | 1 | Model DA Solution\interval\ST Generator(*).Generation.csv |

| Pump Load | Filename | 0 | - | 1 | Model DA Solution\interval\ST Generator(*).Pump Load.csv |

| SRMC | Filename | 0 | - | 1 | Model DA Solution\interval\ST Generator(*).SRMC.csv |

| Pump Price Received | Filename | 0 | - | 1 | Model DA Solution\interval\ST Generator(*).Pump Price Received.csv |

| Und. Capacity | Filename | 0 | - | 1 | Model DA Solution\interval\ST Generator(*).Undispatched Capacity.csv |

| Und. Pump Capacity | Filename | 0 | - | 1 | Model DA Solution\interval\ST Generator(*).Undispatched Pump Capacity.csv |

The following Variable definitions simplify the modelling of the pricing strategy. As an alternative to variables, Offer Price Scalar and Pump Bid Price Scalar can be defined.

| Variable | Property | Value | Data File | Units | Band | Scenario | Memo |

|---|---|---|---|---|---|---|---|

| x1.01 | Sampling Method | None | - | 1 | |||

| x1.01 | Profile | 1.01 | - | 1 | Increase of 1% | ||

| x0.99 | Sampling Method | None | - | 1 | |||

| x0.99 | Profile | 0.99 | - | 1 | Decrease of 1% |

The following RT offer properties are defined for "Pumped Storage 1":

| Property | Value | Units | Band | Data Files | Action | Expression | Scenario | Memo |

|---|---|---|---|---|---|---|---|---|

| Offer Base | 0 | MW | 1 | Generation | RT Offers & Bids | The DA generation | ||

| Offer Quantity | 0 | MW | 1 | Generation | RT Offers & Bids | Decr down to 0MW generation | ||

| Offer Quantity | 0 | MW | 2 | Und. Capacity | RT Offers & Bids | Undispatched generating headroom | ||

| Offer Quantity Scalar | -1 | MW | 1 | - | RT Offers & Bids | Negate to create decr offer | ||

| Offer Quantity Scalar | 1 | MW | 2 | - | RT Offers & Bids | OK to omit (default value) | ||

| Offer Price | 0 | $/MWh | 1 | SRMC | RT Offers & Bids | - | ||

| Offer Price | 0 | $/MWh | 2 | SRMC | x | x1.01 | RT Offers & Bids | DA SRMC + 1% |

To effect the pump load bidding strategy, the following properties are also defined:

| Property | Value | Units | Band | Data Files | Action | Expression | Scenario | Memo |

|---|---|---|---|---|---|---|---|---|

| Pump Bid Base | 0 | MW | 1 | Pump Load | RT Offers & Bids | The DA pump load | ||

| Pump Bid Quantity | 0 | MW | 1 | Pump Load | RT Offers & Bids | Decr down to 0MW load | ||

| Pump Bid Quantity | 0 | MW | 2 | Und. Pump Capacity | RT Offers & Bids | Undispatched pumping | ||

| Pump Bid Quantity Scalar | -1 | MW | 1 | - | RT Offers & Bids | Negate to create decr offer | ||

| Pump Bid Quantity Scalar | 1 | MW | 2 | - | RT Offers & Bids | OK to omit (default value) | ||

| Pump Bid Price | 0 | $/MWh | 1 | Pump Price Received | RT Offers & Bids | - | ||

| Pump Bid Price | 0 | $/MWh | 2 | SRMC | x | x0.99 | RT Offers & Bids | DA Pump Price Received - 1% |